3QFY2018 Result Update | Coffee

February 5, 2018

CCL Products

BUY

CMP

`278

Performance Update

Target Price

`360

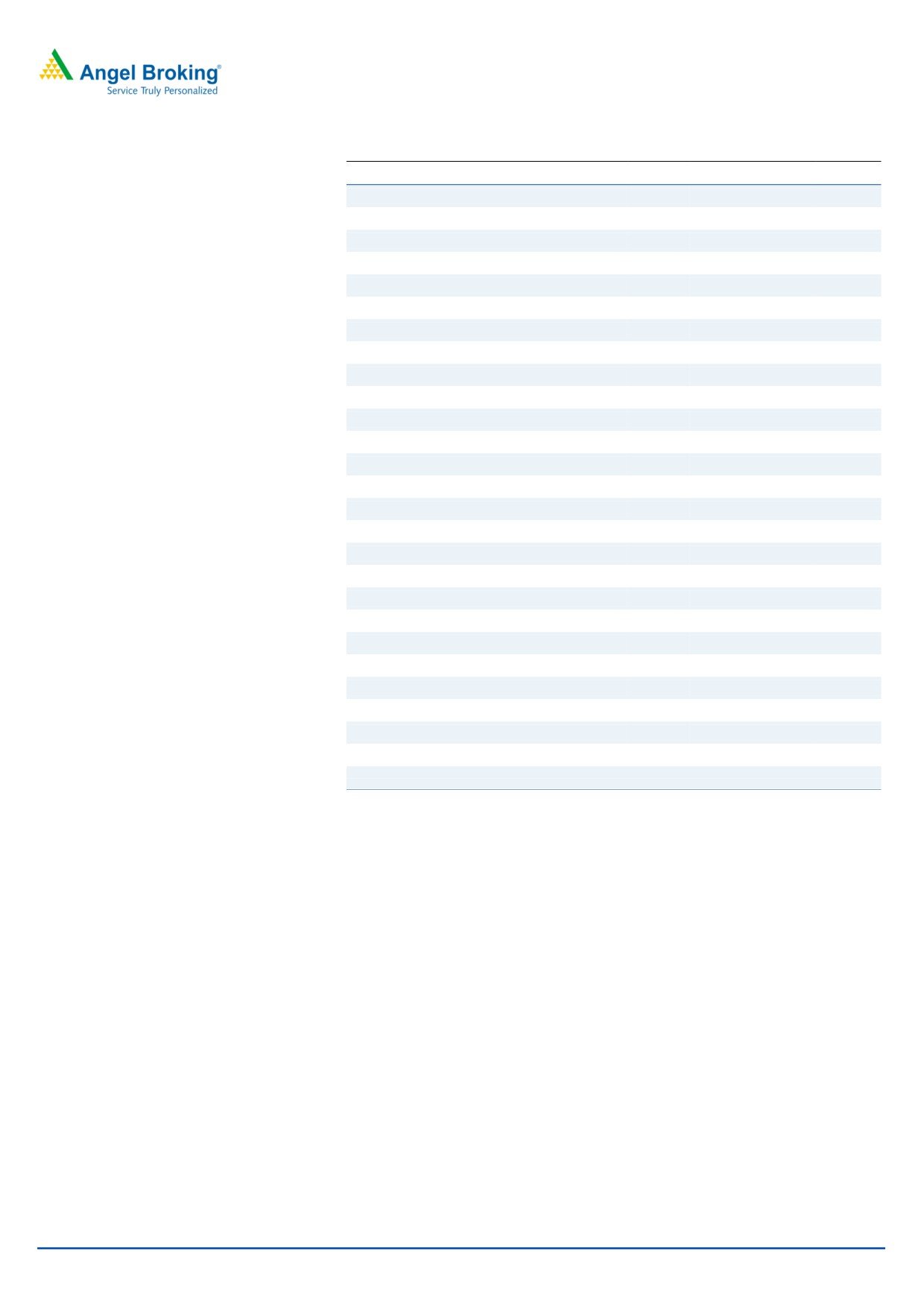

Y/E March (` cr)

Q3FY18

Q3FY17

% yoy

Q2FY18

% qoq

Investment Period

12 month

Net sales

274

289

(5)

296

(8)

EBITDA

65

77

(16)

58

11

Stock Info

EBITDA margin (%)

23.7

26.7

(300bp)

19.5

417bp

Sector

Coffee

Adjusted PAT

40

46

(11)

33

21

Market Cap (Rs cr)

3,699

Source: Company, Angel Research

Net Debt

125

Beta

0.5

For Q3FY18, CCL products (CCL) posted subdued set of results on a strong base

52 Week High / Low

371/ 250

of Q3FY17. The management expects a strong fourth quarter to achieve the

Avg. Daily Volume

4,626

Face Value (Rs)

10

yearly revenue growth guidance of 10%. Revenues degrew by ~5% yoy and while

BSE Sensex

35,067

Nifty

10,760

the operating margins were also lower on yearly basis.

Reuters Code

CCLP.BO

Bloomberg Code

CCLP IN

Revenue fell owing to fall in green prices: The company’s top-line fell by ~5% yoy

to `274 cr due to a fall in green coffee prices while the volume growth was still

Shareholding Pattern (%)

robust. Its Vietnam facility is running at full capacity utilization and reported 16%

Promoters

45.0

growth in revenue.

MF / Banks / Indian Fls

16.3

FII / NRIs / OCBs

25.3

Margins were decent: On the operating front, the company’s margin were robust

Indian Public / Others

13.5

at 23.7% in spite of unfavourable base effect in Indian operations. Q3FY17 was a

exceptional quarter as it had positive spillover effect from previous quarter.

Abs. (%)

3m 1yr

3yr

Sensex

4.5

24.3

19.0

Outlook and Valuation: We maintain our estimates in view of robust offtake

CCL Products

(18.0)

(10.9)

45.0

expectations of its coffee in upcoming quarters. We expect CCL to report a

revenue CAGR of ~18% over FY18-20E mainly due to (a) higher off take from

upcoming facilities in India (b) higher B2C sales via Continental brand; and (c)

better offtake in Vietnam facilities. On the bottom-line front, we expect a higher

CAGR of ~26% to `229cr over the same period on the back of strong revenue

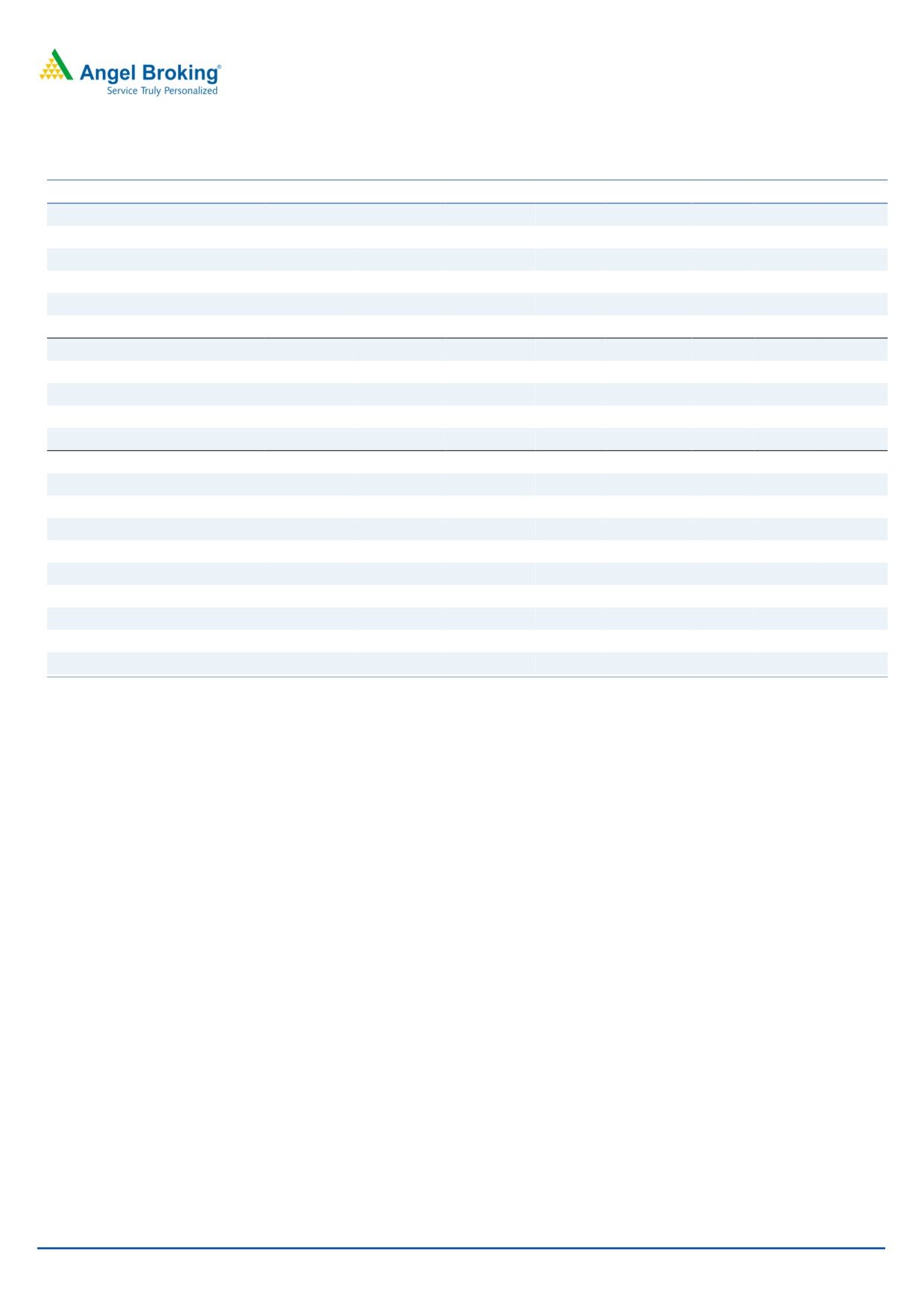

Historical share price chart

and lower interest costs. Post the recent correction, the stock is trading very

400

attractively at 19.3x its FY19E earnings. Thus, we maintain our BUY rating with

350

300

the Target Price of `360.

250

200

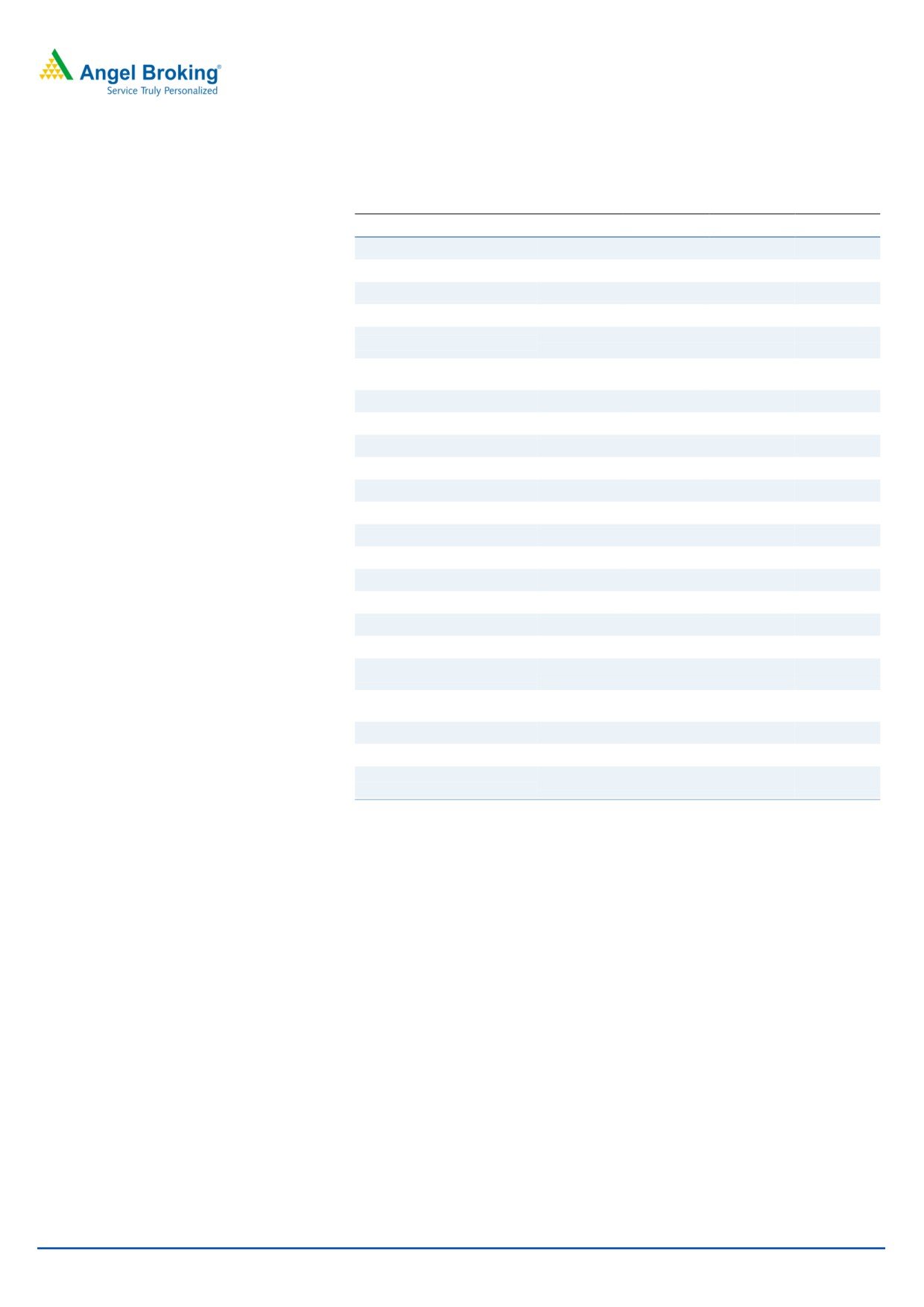

Key Financials

150

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

100

Net Sales

50

976

1165

1408

1608

0

% chg

4.8%

19.3%

20.9%

14.1%

Net Profit

134

144

192

229

% chg

10.0%

7.3%

33.0%

19.2%

Source: Company, Angel Research

OPM (%)

23.9%

21.0%

22.5%

23.0%

EPS (Rs)

10.1

10.8

14.4

17.2

Nidhi Agrawal

P/E (x)

27.5

25.7

19.3

16.2

+022 39357600, Extn: 6872

P/BV (x)

5.8

5.0

4.2

3.5

RoE (%)

21%

20%

22%

22%

RoCE (%)

28%

26%

30%

31%

EV/Sales (x)

3.9

3.3

2.7

2.3

EV/EBITDA (x)

16.4

15.5

11.9

10.1

Please refer to important disclosures at the end of this report

1

CCL products| 3QFY2018 Result Update

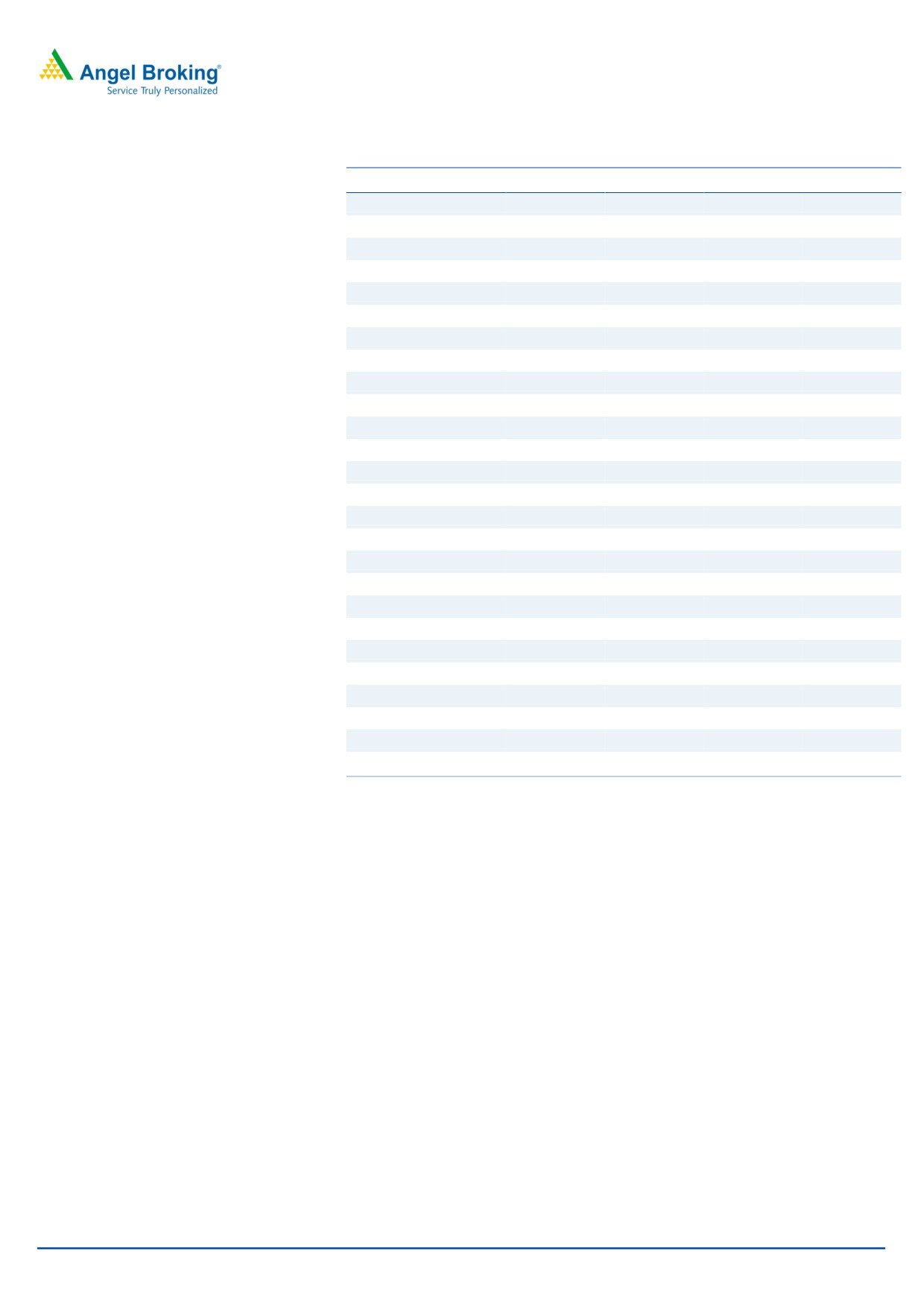

Exhibit 1: Q3FY2018 Performance

Q3FY18

Q3FY17

% yoy Q2FY18

% qoq M9FY18 M9FY17

YOY %

Net Sales

274

289

-5

296

-7.6

817

684

19.5

Other Income

0

0

116

0

57.7

3

1

235.4

Raw Material Consumed

156

150

4

208

-24.9

530

397

33.6

Stock Adjustments

-1

-1

-20

-23

-94.5

-37

-24

51.1

Employee Expenses

12

14

-13

11

7.5

34

29

13.9

Other Expenses

43

50

-14

43

0.1

122

114

7.7

As a % of net sales

Raw Material Consumed

57%

52%

70%

65%

58%

Stock Adjustments

0%

0%

-8%

-4%

-4%

Employee Expenses

4%

5%

4%

4%

4%

Other Expenses

16%

17%

14%

15%

17%

Total expenditure

210

212

-1

239

-12.3

649

516

25.9

Operating profit

65

77

-16

58

12.2

171

169

1.2

OPM %

23.7%

26.7%

19.5%

20.9%

24.7%

Interest

2

3

-27

2

-11.9

6

8

-23.9

Depreciation

8

9

-3

9

-2.2

25

26

-1.1

PBT

55

66

-17

47

15.9

140

136

3.0

Tax

14

19

-26

14

3.7

39

35

10.0

Tax rate %

26%

29%

29%

28%

26%

PAT

40

46

-11

33

20.9

101

99

2.0

PAT margin %

14.8%

15.8%

11.3%

12.3%

14.5%

Source: Company, Angel Research

February 5, 2018

2

CCL products| 3QFY2018 Result Update

Outlook and Valuation

We maintain our estimates in view of robust offtake expectations of its coffee in

upcoming quarters. We expect CCL to report a revenue CAGR of ~18% over

FY18-20E mainly due to (a) higher off take from upcoming facilities in India (b)

higher B2C sales via Continental brand; and (c) better offtake in Vietnam facilities.

On the bottom-line front, we expect a CAGR of ~26% to `229cr over the same

period on the back of strong revenue and lower interest costs. Post the recent

correction, the stock is trading very attractively at 19.3x its FY19E earnings. Thus,

we maintain our Buy rating with the Target Price of `360.

Risks to our estimates

1) Inability to get break through with new clients as the volumes may get

impacted

2) Abrupt fluctuations in coffee prices may adversely impact its profitability

Company Background

CCL was founded in 1994 as an Export Oriented Unit (EOU) with the right to

import green coffee from any part of the world and export processed coffee

across the globe, devoid of any duties. The company’s instant coffee

manufacturing plant is located at Guntur District, Andhra Pradesh, with a

current combined capacity of 20,000MT/PA. CCL also has a plant in Vietnam

with a total capacity of 1,0000MT for instant coffee and 5000MT for liquid

coffee. CCL’s 3,000MT plant in Switzerland is facing issues on account of

unfavorable European Union regulations.

Major clientele and geographies

The major countries contributing to CCL’s export revenue are Italy, Russia,

Belgium, Japan Germany, China etc. A few private labels served by CCL

include Mokate, Instanta, Food Empire, Strauss, DEK, Gold Roast, etc.

Presently, the company provides over 200 varieties and blends of coffee to its

customers in over 90 countries.

February 5, 2018

3

CCL products| 3QFY2018 Result Update

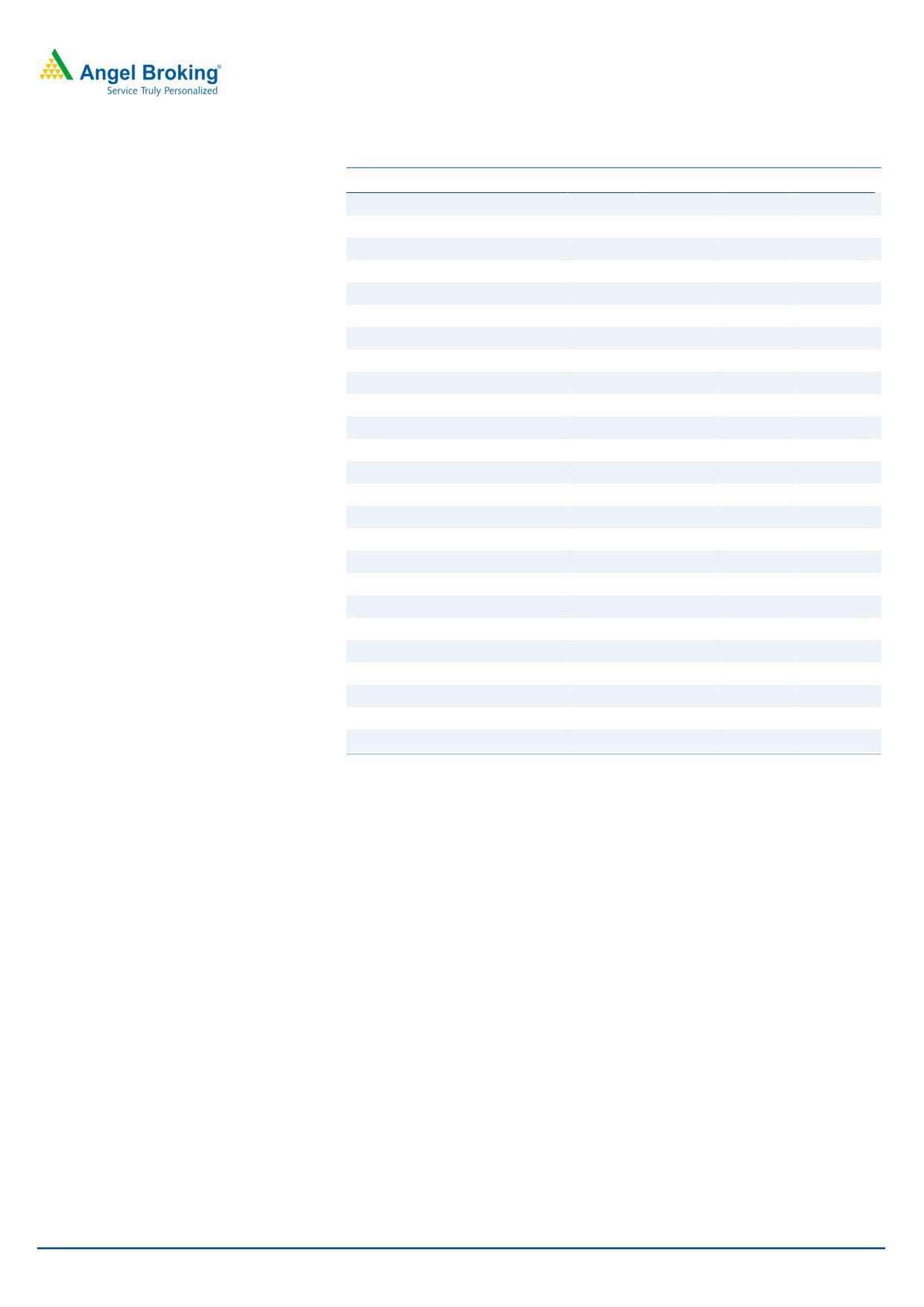

Profit & Loss Statement

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

Total operating income

976

1165

1408

1608

% chg

5

19

21

14

Total Expenditure

743

920

1092

1238

Raw Material

552

635

730

839

Personnel

28

31

34

37

Others Expenses

163

180

198

217

EBITDA

233

245

317

370

% chg

9

5

30

17

(% of Net Sales)

24

21

23

23

Depreciation& Amortisation

33

36

41

42

EBIT

200

209

276

328

% chg

7

4

32

19

(% of Net Sales)

20

18

20

20

Interest & other Charges

11

5

4

4

Other Income

-0.11

2.00

2.00

2.00

(% of PBT)

-0.1%

1.0%

0.7%

0.6%

Share in profit of Associates

-

-

-

-

Recurring PBT

189

206

274

326

Tax

55

62

82

98

(% of PBT)

28.9

30.0

30.0

30.0

PAT (reported)

134

144

192

229

% chg

10

7

33

19

(% of Net Sales)

14

12

14

14

Basic EPS (Rs)

10.1

10.8

14.4

17.2

Fully Diluted EPS (Rs)

10.1

10.8

14.4

17.2

% chg

10

7

33

19

February 5, 2018

4

CCL products| 3QFY2018 Result Update

Balance Sheet

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

27

27

27

27

Reserves& Surplus

610

710

853

1028

Shareholders Funds

636

736

880

1055

Minority Interest

Total Loans

142

142

122

102

Total Liabilities

778

878

1002

1157

APPLICATION OF FUNDS

Gross Block

643

743

843

943

Less: Acc. Depreciation

250

286

327

368

Net Block

393

458

517

575

Capital Work-in-Progress

0

0

0

0

Investments

2

2

2

2

Current Assets

404

443

508

606

Inventories

183

201

221

243

Sundry Debtors

163

171

189

207

Cash and Bank

17

27

53

107

Loans and Advances

42

44

46

48

Current liabilities

39

43

45

48

Net Current Assets

365

400

463

559

Deferred Tax Asset

-31

-32

-34

-36

Other Assets

49

52

55

57

Mis. Exp. not written off

-

-

-

-

Total Assets

779

879

1002

1157

February 5, 2018

5

CCL products| 3QFY2018 Result Update

Consolidated Cashflow Statement

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

PBT

189

206

274

326

OCF before chg in WC and tax

226

244

317

370

Adjusted for:

Change in WC

(67)

(20)

(32)

(118)

Taxes paid

(53)

(62)

(82)

(98)

Others

0

0

0

0

Cash flow from operations

105

162

202

155

Investment in assets

(20)

(100)

(100)

(20)

Other investments/sales

0

Investing Cash Flow

(20)

-100

-100

-20

Borrowings

(68)

0

(20)

(20)

Equity issuances

0

0

0

0

Dividends paid

(13)

(44)

(48)

(53)

Interest paid

(4)

(5)

(4)

(4)

Others

(3)

(3)

(3)

(4)

Financing Cash Flow

(87)

(52)

(76)

(80)

Net Change in Cash

(2)

10

26

54

Opening Cash

19

17

27

53

Closing Cash

17

27

53

107

Free cash flow

85

62

102

135

February 5, 2018

6

CCL products| 3QFY2018 Result Update

Key Ratios

Y/E March

FY2017

FY2018E

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

27.5

25.7

19.3

16.2

P/CEPS

22.1

20.6

15.9

13.7

P/BV

5.8

5.0

4.2

3.5

EV/Sales

3.9

3.3

2.7

2.3

EV/EBITDA

18.1

16.4

15.5

11.9

EV / Total Assets

9.7

8.3

7.3

6.5

Per Share Data (Rs)

EPS (Basic)

10.1

10.8

14.4

17.2

EPS (fully diluted)

10.1

10.8

14.4

17.2

Cash EPS

12.6

13.5

17.5

20.3

DPS

2.5

2.8

3.0

3.3

Book Value

47.8

55.4

66.1

79.3

Returns (%)

ROCE

27.5%

25.9%

30.1%

31.0%

Angel ROIC (Pre-tax)

26.3%

24.6%

29.1%

31.3%

ROE

21.1%

19.6%

21.8%

21.7%

Turnover ratios (x)

Asset Turnover (Gross Block)

2.5

2.5

2.7

2.8

Inventory / Sales (days)

62

60

55

53

Receivables (days)

54

52

47

45

Payables (days)

22

16

15

14

Working capital cycle (ex-cash)

94

96

87

84

(days)

Source: Company, Angel Research

February 5, 2018

7

CCL products| 3QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

CCL Products

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

February 5, 2018

8